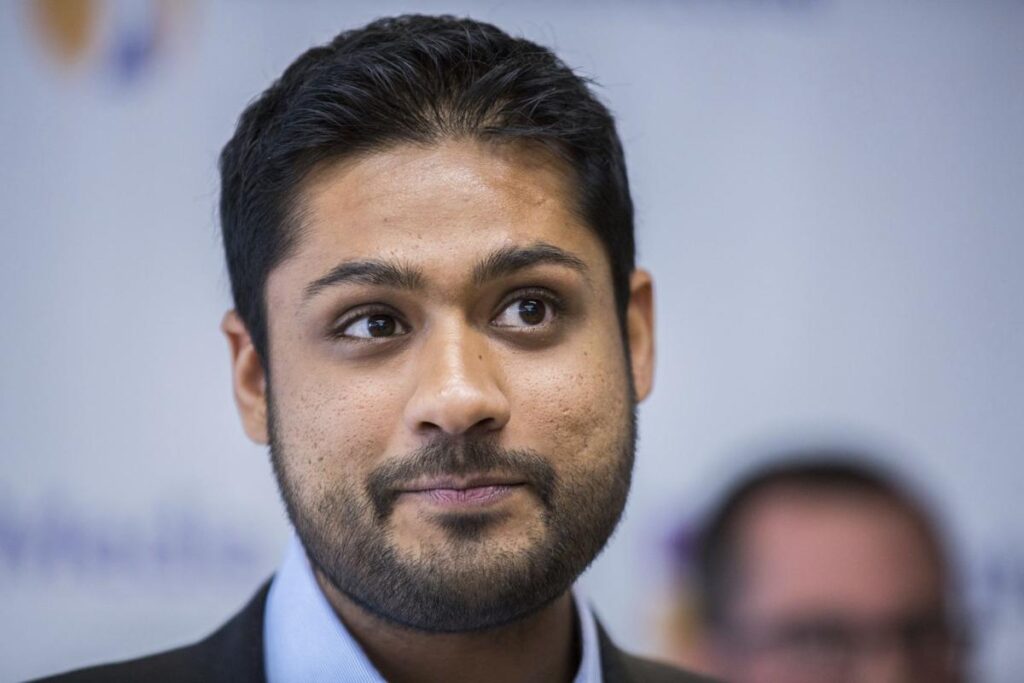

Health co-founders Rishi Shah and Shradha Agarwal have been indicted, along with former chief financial officer Brad Purdy, by a federal grand jury on fraud charges in connection with a scheme to overbill customers of the healthcare-advertising company that became one of Chicago’s most high-profile startups.

Shah, 33, the company’s former CEO, is charged with six counts of mail fraud, 12 counts of wire fraud and two counts each of bank fraud and money laundering.

Agarwal, 34, the former president, is charged with six counts of mail fraud, nine counts of wire fraud and two counts of bank fraud. Purdy, 30, is charged with six counts each of mail fraud and wire fraud, two counts of bank fraud and one count of making a false statement to a bank.

Ashik Desai, 26, a former executive vice president, was charged with one count of wire fraud Nov. 14.

Shah’s attorneys said in a statement he “did not commit these offenses and denies the government’s charges against him. He is being scapegoated for the wrongdoing of others who have cut deals with the government to reduce their own exposure. Mr. Shah will plead not guilty to these charges because he is, in fact, not guilty of any of them. He looks forward to his day in court and the opportunity to clear his name.”

In a statement, Agarwal’s attorneys said she “never committed fraud and never participated in any conspiracy. To the contrary, Shradha was committed to transparency and integrity at Outcome Health. She will fight to protect her good name in court.”

Purdy’s attorney, Theodore Poulos, said, “These charges against Brad Purdy are false and misguided. “Brad acted in good faith and firmly believed that Outcome Health was a properly run company.”

If convicted, Shah, Agarwal and Purdy could be sentenced to as many as 30 years in prison. Desai faces up to 20 years. Federal authorities also hope to seize any property the defendants gained, particularly money that went to Jumpstart Ventures, a venture fund run by Shah, Agarwal and Purdy. The government identifies more than $30 million that went to Shah, Agarwal or investment funds and startups.

They also face a complaint by the U.S. Securities and Exchange Commission.

The criminal indictment, unsealed today, is the latest chapter in a two-year scandal that hobbled Outcome Health, formerly called ContextMedia, one of Chicago’s most high-profile startups. Crain’s first reported that a federal grand jury was investigating the case. Shah and Agarwal were forced out of the company, which is trying to rebuild its business.

Things began to unravel two years ago, after Outcome made headlines for raising nearly half a billion dollars, when the Wall Street Journal first reported Outcome had to repay pharmaceutical company customers for advertising that was purchased but didn’t run on the company’s network of television screens in doctors’ offices.

The company initially portrayed the fraud as something done by rogue employees. But the indictment claims that Shah, Agarwal and Purdy were aware of the problems early on and were aware of, or coordinated, efforts to conceal them.

According to the indictment, at least two executives hired in early 2017, had sounded alarms about potential fraud at the company.

In a voice message Shah on Jan. 23, 2017—as Outcome was raising its large investment round and before rumors of overfilling surfaced publicly — Agarwal details that a newly hired senior executive raised warnings of fraud, worrying that 50 percent of Outcome’s revenue could be at risk and told them he thought Desai was changing numbers. The executive also began questioning affidavits that in which the company verified that it delivered what advertisers had paid for, the indictment says.

“If (two unnamed executives) are coming to him in his first week and sharing this, that is not very good leadership on their part, and we may just have to clean up in a lot of different areas of that org,” Agarwal said, according to the complaint.

The next day, according to the indictment, Shah sent a text message to Agarwal and Desai that said: “My sense is you potentially cycle (the executives) out and bring in people who can fix the issues.”

The executive who sounded the alarm indicated that the fraud would become public, after which Shah sent a voice message to Agarwal saying, ‘I’m a little nervous about not firing him tomorrow if I can’t figure out he’s really trustworthy.”

Outcome got a whistleblower complaint Feb. 1, 2017, from another newly hired executive who warned Outcome was inflating prescription sales results related to its advertising.

On Feb. 10, according to the indictment, Shah wrote Agarwal and Desai: ’I also thought about how those two trouble-making fuckers in growth strategy were going to exit soon—and a few weeks after that see a $450M round in the WSJ from (investors) valuing us at $5B and probably shed some tears, which I’ll confide provided some motivation, too! Thought I would save that just for this group; ha.”

Shah seized the spotlight in late May 2017, trumpeting the $487 million investment that purported to value his company at more than $5 billion and putting him in the club of founders of privately held “unicorn” companies, such as Uber and WeWork, that were valued at more than $1 billion.

Federal authorities say that fundraising and a previous $110 million deal in 2016 allowed Agarwal and Shah them to pay themselves dividends totaling $262 million. If the feds convict them, the plan to attempt to seize up to $30 million.